Mark Beaver

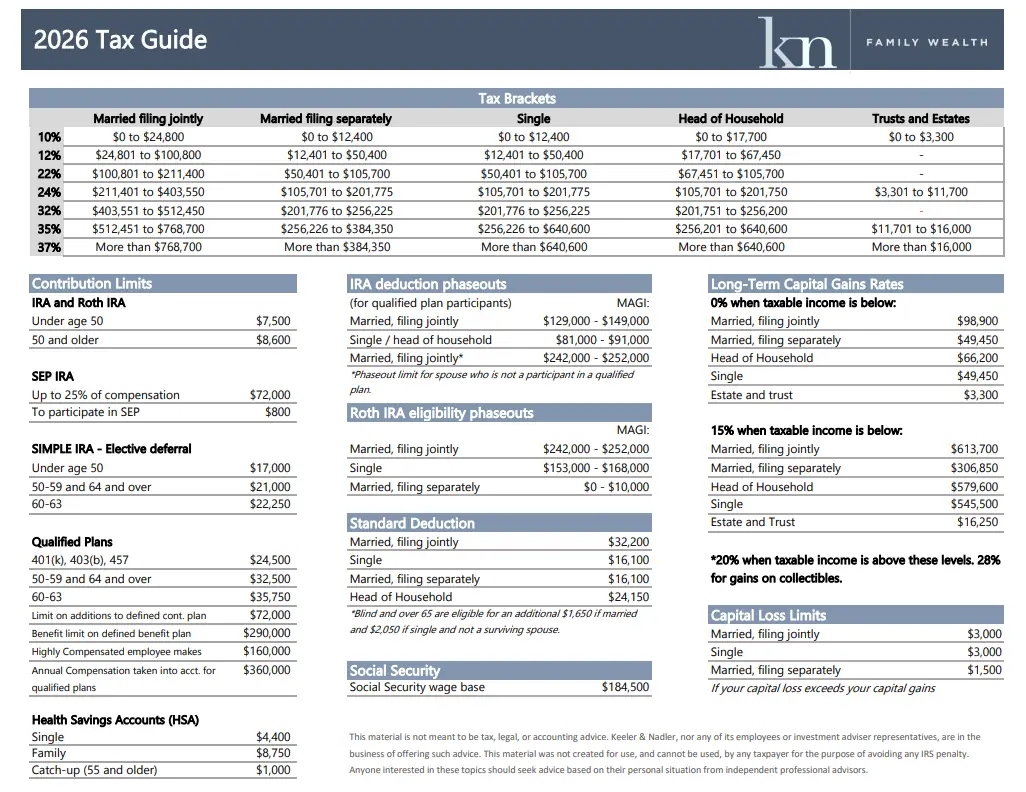

The Keeler & Nadler Family Wealth 2026 Tax Guide is now available.

Each year, tax law updates create new planning opportunities and potential pitfalls for individuals, families, and business owners. Our latest guide highlights the most important changes you need to be aware of as you plan for the year ahead.

Feburary 11, 2026 | 11 min read

Key Tax Updates for 2026

Retirement Plan Contribution Limits

Several retirement account limits have increased, creating new opportunities for tax-efficient saving:

401(k) / 403(b) / TSP & Employer-Sponsored Plans

Employee contribution limit increased to $24,500

Catch-up contribution for individuals age 50+ increased to $8,000

Enhanced catch-up contribution for ages 60–63 remains $11,250

Maximum Total Employee Contribution

Ages 50–59 or 64+: $32,500

Ages 60–63: $35,750

Important note: Catch-up contributions will be required to be Roth contributions if your income exceeded $150,000 in 2025, adding another layer of planning consideration.

IRA & Roth IRA Contribution Limits

Contribution limit increased to $7,500

Catch-up contribution (age 50+) increased to $1,100

These limits apply to the combined total of Traditional and Roth IRA contributions.

Roth IRA Income Phase-Out Ranges (MAGI)

Eligibility for Roth IRA contributions continues to phase out at higher income levels:

Single or Head of Household: $153,000 – $168,000

Married Filing Jointly: $242,000 – $252,000

Married Filing Separately: $0 – $10,000

Understanding these thresholds is critical for avoiding excess contributions and identifying alternative planning strategies.

Why These Changes Matter

Tax updates don’t exist in isolation. Changes to contribution limits, income thresholds, and account rules can impact:

Retirement savings strategy

Roth vs. Traditional contribution decisions

Cash flow planning

Long-term tax efficiency

At Keeler & Nadler Family Wealth, we believe informed and proactive tax planning is a cornerstone of long-term financial success. Every financial situation is unique, and the right strategy often depends on how these rules interact with your broader financial picture.

Let’s Plan Ahead

We encourage you to connect with our team for a personalized conversation about how the 2025 tax updates affect your specific goals. Together, we can evaluate opportunities, avoid costly mistakes, and align your tax strategy with your long-term wealth plan.

Keeler & Nadler Family Wealth is proud to serve individuals and families across Central Ohio, including Dublin, Columbus, Powell, Worthington, and Hilliard.

More Recent Blogs

Smart money tips & life planning advice

Executive Summary: Should I Pay Off My Mortgage? Buy or Lease A Car? It’s Mind Vs. Math

Andy KeelerExecutive Summary: Should I Pay Off My Mortgage? Buy or Lease A Car? It's Mind Vs. Math In this mailbag episode, Andy Keeler is joined by Abby Rose, CFP®, CPA; Mark Beaver, CFP®; and Jake Martin, CFP®, to answer common financial questions from clients...

The Blind Spots That Cost DIY Investors Thousands

Discover why even savvy DIY investors—doctors, lawyers, and executives—turn to KN Family Wealth for tax planning, retirement strategies, and peace of mind. Listen now on the Keeler & Nadler Podcast.

The Ultimate College-Readiness Financial Checklist for High-Net-Worth Families

Prepare your child for college with this financial checklist for high-net-worth families. From legal protections to tuition planning, ensure a secure transition. This carefully organized checklist highlights the critical areas to focus on, from legal healthcare protections and financial readiness to tuition planning and insurance considerations.

How the New ‘One Big Beautiful Bill’ Might Impact Your Taxes

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act (OBBBA) into law, introducing major tax changes for high-income individuals and families. From permanent lower income tax rates to new deductions, expanded credits, and estate tax updates, here’s what you need to know about how this legislation could impact your finances.

What Is a Legacy Contact—and Why Every Central Ohio Family Should Set One Up

Did you know the only way to access a deceased person’s iPhone (legally) is through a court order or other legal documentation? Both of these options sound time-consuming and stressful, but is there another option?

The Foundation of a Strong Financial Plan for Central Ohio Families

Did you know the only way to access a deceased person’s iPhone (legally) is through a court order or other legal documentation? Both of these options sound time-consuming and stressful, but is there another option?

Modern solutions for the inevitable need of long-term care

Navigate the evolving landscape of long-term care (LTC) insurance, focusing on hybrid insurance policies and strategies across different financial demographics.

How Behavioral Economics Can Improve Financial Decisions | Financial Opportunities Uncovered

Discover how psychology and behavioral economics influence your financial decisions. In this episode, Andy Keeler and Dr. Drew Hanks explore strategies to outsmart impulse buys, negotiate better, and save more.

Understanding the Federal Reserve’s Rate Cut: Impact on Your Finances

As you may have heard, the Federal Reserve recently cut its benchmark lending rate, and many are wondering how this affects their financial situation.

2025 – 2026 FAFSA Filing Delays

As we wrap up the third quarter of 2024 and enter the fall season, typically this means our clients

with college-age children are entering “FAFSA Season.”