Mark Beaver

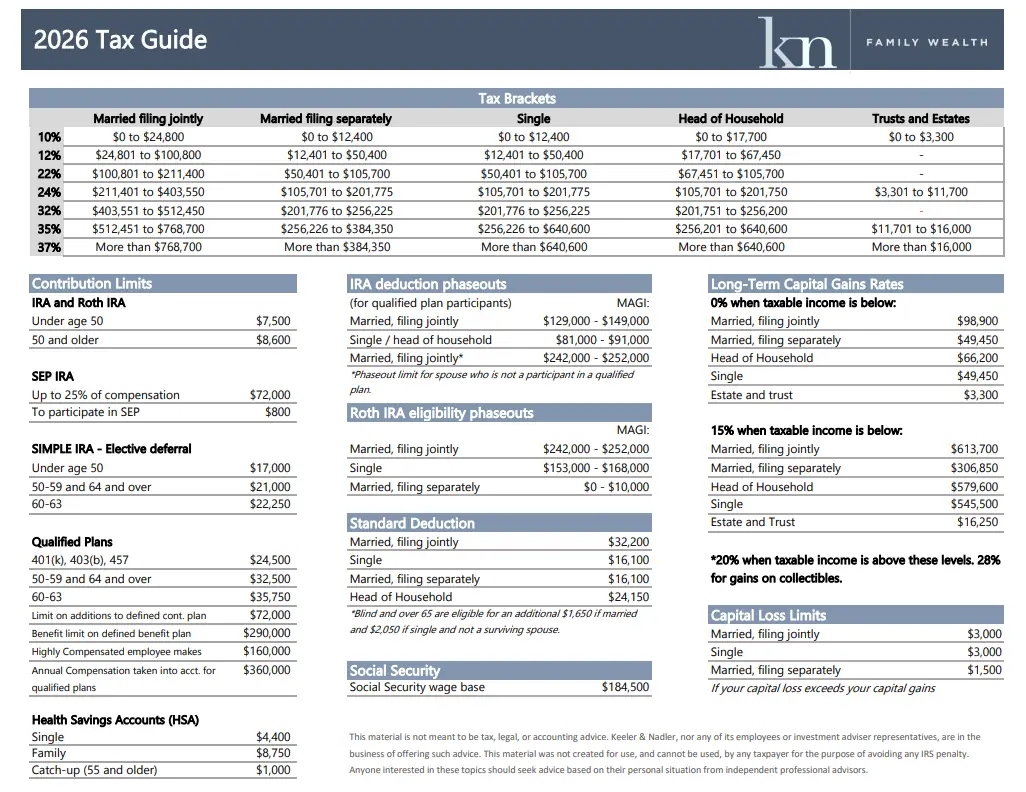

The Keeler & Nadler Family Wealth 2026 Tax Guide is now available.

Each year, tax law updates create new planning opportunities and potential pitfalls for individuals, families, and business owners. Our latest guide highlights the most important changes you need to be aware of as you plan for the year ahead.

Feburary 11, 2026 | 11 min read

Key Tax Updates for 2026

Retirement Plan Contribution Limits

Several retirement account limits have increased, creating new opportunities for tax-efficient saving:

401(k) / 403(b) / TSP & Employer-Sponsored Plans

Employee contribution limit increased to $24,500

Catch-up contribution for individuals age 50+ increased to $8,000

Enhanced catch-up contribution for ages 60–63 remains $11,250

Maximum Total Employee Contribution

Ages 50–59 or 64+: $32,500

Ages 60–63: $35,750

Important note: Catch-up contributions will be required to be Roth contributions if your income exceeded $150,000 in 2025, adding another layer of planning consideration.

IRA & Roth IRA Contribution Limits

Contribution limit increased to $7,500

Catch-up contribution (age 50+) increased to $1,100

These limits apply to the combined total of Traditional and Roth IRA contributions.

Roth IRA Income Phase-Out Ranges (MAGI)

Eligibility for Roth IRA contributions continues to phase out at higher income levels:

Single or Head of Household: $153,000 – $168,000

Married Filing Jointly: $242,000 – $252,000

Married Filing Separately: $0 – $10,000

Understanding these thresholds is critical for avoiding excess contributions and identifying alternative planning strategies.

Why These Changes Matter

Tax updates don’t exist in isolation. Changes to contribution limits, income thresholds, and account rules can impact:

Retirement savings strategy

Roth vs. Traditional contribution decisions

Cash flow planning

Long-term tax efficiency

At Keeler & Nadler Family Wealth, we believe informed and proactive tax planning is a cornerstone of long-term financial success. Every financial situation is unique, and the right strategy often depends on how these rules interact with your broader financial picture.

Let’s Plan Ahead

We encourage you to connect with our team for a personalized conversation about how the 2025 tax updates affect your specific goals. Together, we can evaluate opportunities, avoid costly mistakes, and align your tax strategy with your long-term wealth plan.

Keeler & Nadler Family Wealth is proud to serve individuals and families across Central Ohio, including Dublin, Columbus, Powell, Worthington, and Hilliard.

More Recent Blogs

Smart money tips & life planning advice

Investing During an Election Year

Did you know the only way to access a deceased person’s iPhone (legally) is through a court order or other legal documentation? Both of these options sound time-consuming and stressful, but is there another option?

Reminder: The Stock Market Goes Down Sometimes

Reminder: The Stock Market Goes Down SometimesMark Beaver Apr 19, 2024 | 8 min readIf you ask almost any longtime investor if the stock market can be volatile, they would say, "Yes." They may also tell you to "Ignore short-term market fluctuations" and "stay focused...

What is the Bank Paying YOU?

What is the Bank Paying YOU?Andy Keeler, CFP®Feb 23, 2024 | 9 min readWhat is the bank paying you on your savings? Most people realize that it’s usually not a lot. But there is some comfort in having a stash at the brick-and-mortar bank up the street. As you know, the...

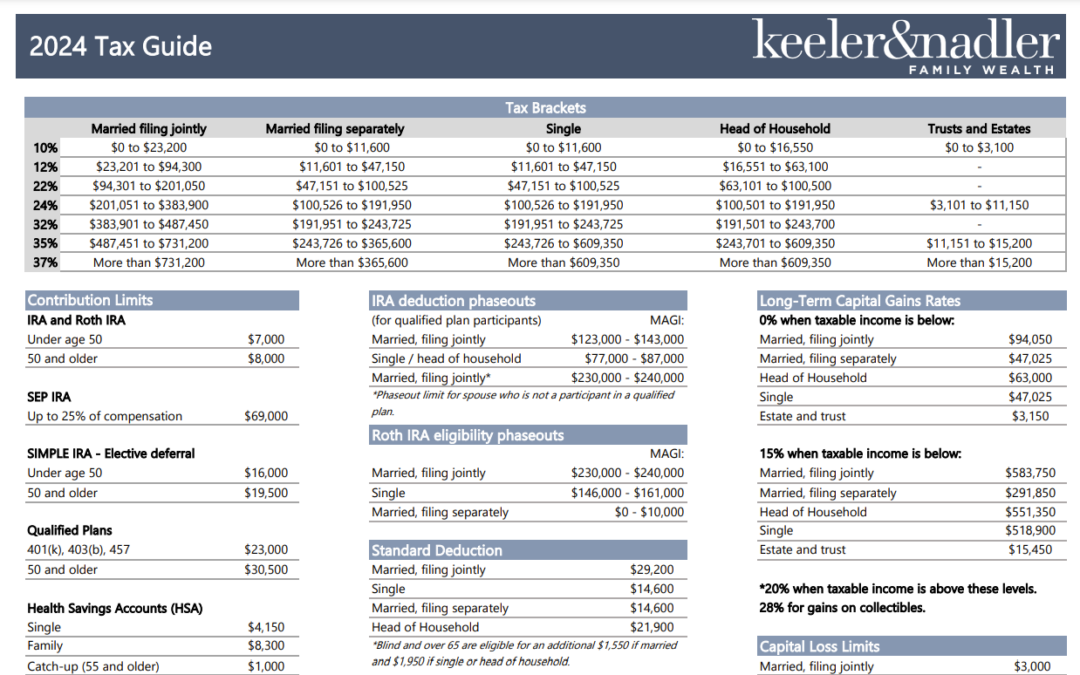

2024 Tax Guide

The Keeler & Nadler Tax Guide for 2024 is now available!

Rolling a 529 into a Roth IRA

Rolling a 529 into a Roth IRAJessica Hultberg, CFP®Nov 20, 2023 | 4 min readSaving for your kid’s college can be a daunting task. In recent years, 529 savings plans have become a popular tool for saving for college in a tax-efficient way. One concern, however, is you...

The Home Downsizing Dilemma

The Home Downsizing DilemmaAndy Keeler, CFP®Nov 6, 2023 | 6 min readThe topic of selling the home that you raised a family in is inevitably one that comes up at your monthly euchre party. There are many different aspects to consider when evaluating the possibility of...

Social Security and Medicare Premium Changes for 2024

This week, the Social Security Administration announced a 3.2% cost of living adjustment for Social Security benefits.

Recent Updates to Inherited IRA Required Minimum Distributions

The Keeler & Nadler Tax Guide for 2022 is now available! In addition to updated tax brackets and retirement account funding limits, this year’s edition includes…

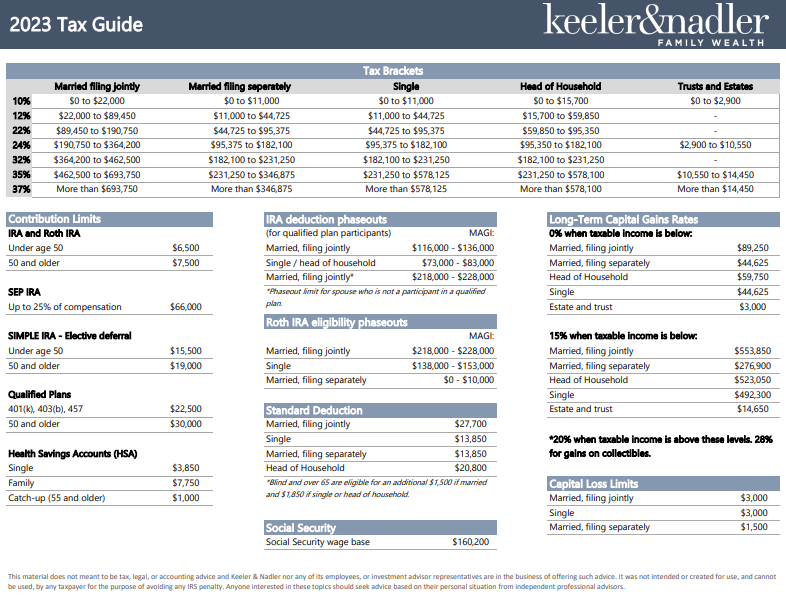

2023 Tax Guide

The Keeler & Nadler Tax Guide for 2022 is now available! In addition to updated tax brackets and retirement account funding limits, this year’s edition includes…

Social Security Up, Medicare Premiums Down

In 2021, there was very little conversation about interest rates – other than everyone refinancing their mortgages at all-time lows.