Mark Beaver

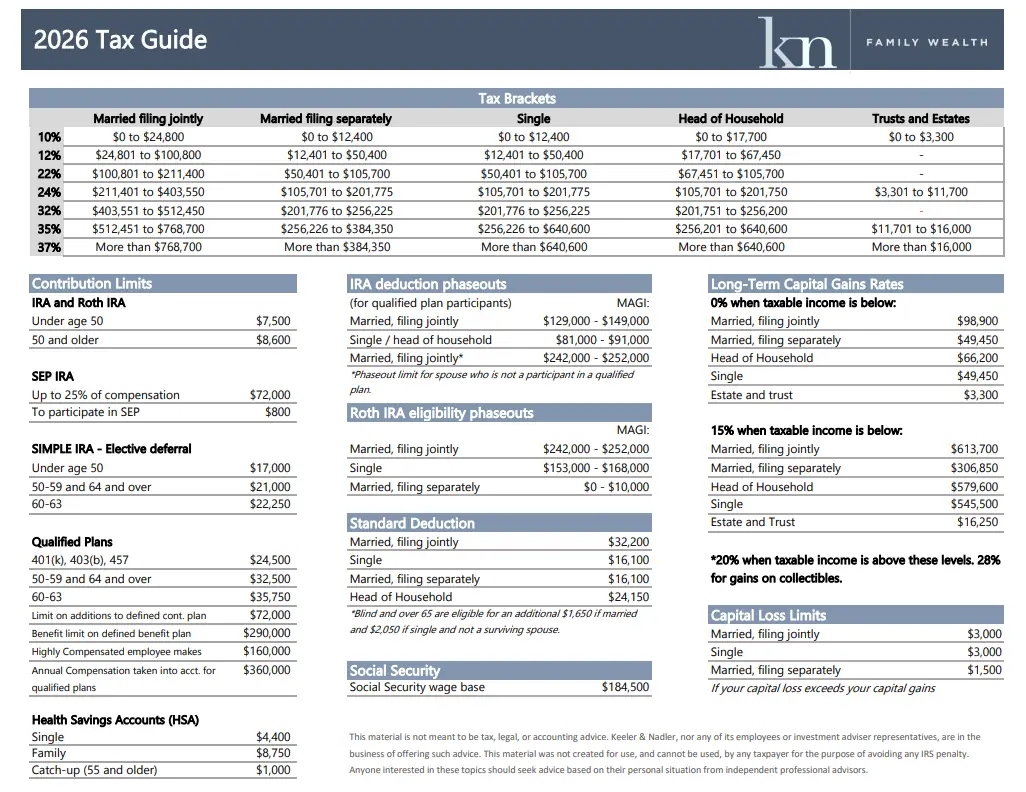

The Keeler & Nadler Family Wealth 2026 Tax Guide is now available.

Each year, tax law updates create new planning opportunities and potential pitfalls for individuals, families, and business owners. Our latest guide highlights the most important changes you need to be aware of as you plan for the year ahead.

Feburary 11, 2026 | 11 min read

Key Tax Updates for 2026

Retirement Plan Contribution Limits

Several retirement account limits have increased, creating new opportunities for tax-efficient saving:

401(k) / 403(b) / TSP & Employer-Sponsored Plans

Employee contribution limit increased to $24,500

Catch-up contribution for individuals age 50+ increased to $8,000

Enhanced catch-up contribution for ages 60–63 remains $11,250

Maximum Total Employee Contribution

Ages 50–59 or 64+: $32,500

Ages 60–63: $35,750

Important note: Catch-up contributions will be required to be Roth contributions if your income exceeded $150,000 in 2025, adding another layer of planning consideration.

IRA & Roth IRA Contribution Limits

Contribution limit increased to $7,500

Catch-up contribution (age 50+) increased to $1,100

These limits apply to the combined total of Traditional and Roth IRA contributions.

Roth IRA Income Phase-Out Ranges (MAGI)

Eligibility for Roth IRA contributions continues to phase out at higher income levels:

Single or Head of Household: $153,000 – $168,000

Married Filing Jointly: $242,000 – $252,000

Married Filing Separately: $0 – $10,000

Understanding these thresholds is critical for avoiding excess contributions and identifying alternative planning strategies.

Why These Changes Matter

Tax updates don’t exist in isolation. Changes to contribution limits, income thresholds, and account rules can impact:

Retirement savings strategy

Roth vs. Traditional contribution decisions

Cash flow planning

Long-term tax efficiency

At Keeler & Nadler Family Wealth, we believe informed and proactive tax planning is a cornerstone of long-term financial success. Every financial situation is unique, and the right strategy often depends on how these rules interact with your broader financial picture.

Let’s Plan Ahead

We encourage you to connect with our team for a personalized conversation about how the 2025 tax updates affect your specific goals. Together, we can evaluate opportunities, avoid costly mistakes, and align your tax strategy with your long-term wealth plan.

Keeler & Nadler Family Wealth is proud to serve individuals and families across Central Ohio, including Dublin, Columbus, Powell, Worthington, and Hilliard.

More Recent Blogs

Smart money tips & life planning advice

Is Your Bank Paying You Enough

In 2021, there was very little conversation about interest rates – other than everyone refinancing their mortgages at all-time lows.

Preparing for Retirement

Heading into retirement can feel like going into the “Great Unknown”. In this webinar, we will discuss how to transition from your career to a successful and stress-free retirement…

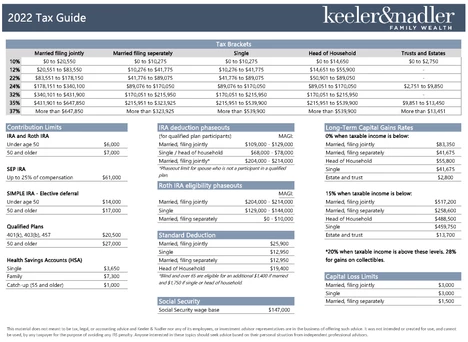

2022 Tax Guide

The Keeler & Nadler Tax Guide for 2022 is now available! In addition to updated tax brackets and retirement account funding limits, this year’s edition includes…

4 Charitable Giving Strategies

Building wealth and financial security for your family is a wonderful thing, but there are many benefits – both financially and personally…

Our Newest CFP!

It is with great pride that Keeler & Nadler Family Wealth wishes to announce and extend congratulations to Jessica Hultberg for her recent achievement of her…

Game Over for GameStop?

Game Over for GameStop? Mark BeaverMarch 2, 2020 | 1 min readIt was hard to escape the news coverage of the frenzy over GameStop stock over the last few weeks.Stories of overnight millionaires battling the hedge fund billionaires over a small video game retailer’s...

It’s Time to Sweat the Small Stuff

It's Time to Sweat the Small StuffAndy Keeler Aug 1, 2020 | 1 min readWe all face obstacles, big and small, in our quest to accumulate wealth. Most of us overlook these small detractors, having to make decisions in the heat of the moment, based on emotion, or simply...

Can you save too much for retirement?

Can you save too much for retirement?Mark BeaverJul 2, 2020 | 1 min readSenior Financial Advisor, Mark Beaver, was asked for his thoughts on the subject in a recent MarketWatch article....

Pay for College or Save for Retirement…?

Pay for College or Save for Retirement...?Mark BeaverJun 25, 2019 | 1 min readOne of our Senior Financial Advisors, Mark Beaver, was recently quoted in an article discussing the dilemma some families are facing today: "Should we delay saving for retirement to help pay...

2019 Tax Facts and Figures

2019 Tax Facts and FiguresMark Beaver Jan 9, 2019 | 2 min readUpdates for 2019 may not be as dramatic as last year, but there are still some very import updates to contribution limits this year. If you are one that maxes out contributions to IRAs, Roths, 401(k)/403(b)...