Mark Beaver

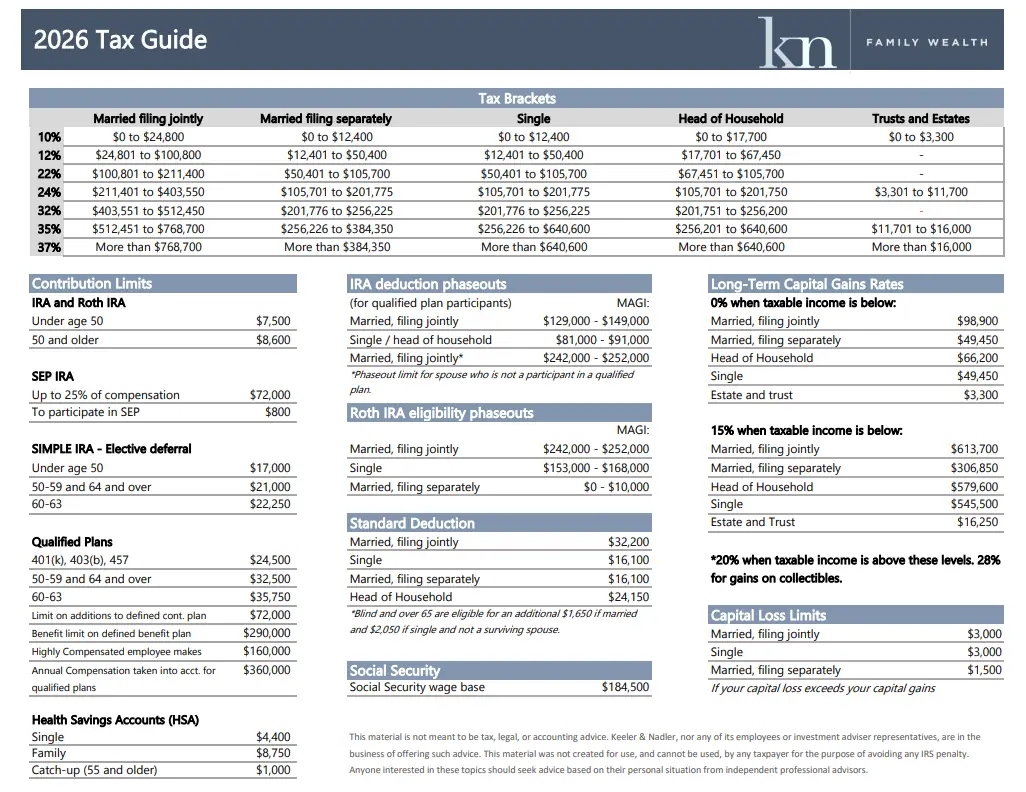

The Keeler & Nadler Family Wealth 2026 Tax Guide is now available.

Each year, tax law updates create new planning opportunities and potential pitfalls for individuals, families, and business owners. Our latest guide highlights the most important changes you need to be aware of as you plan for the year ahead.

Feburary 11, 2026 | 11 min read

Key Tax Updates for 2026

Retirement Plan Contribution Limits

Several retirement account limits have increased, creating new opportunities for tax-efficient saving:

401(k) / 403(b) / TSP & Employer-Sponsored Plans

Employee contribution limit increased to $24,500

Catch-up contribution for individuals age 50+ increased to $8,000

Enhanced catch-up contribution for ages 60–63 remains $11,250

Maximum Total Employee Contribution

Ages 50–59 or 64+: $32,500

Ages 60–63: $35,750

Important note: Catch-up contributions will be required to be Roth contributions if your income exceeded $150,000 in 2025, adding another layer of planning consideration.

IRA & Roth IRA Contribution Limits

Contribution limit increased to $7,500

Catch-up contribution (age 50+) increased to $1,100

These limits apply to the combined total of Traditional and Roth IRA contributions.

Roth IRA Income Phase-Out Ranges (MAGI)

Eligibility for Roth IRA contributions continues to phase out at higher income levels:

Single or Head of Household: $153,000 – $168,000

Married Filing Jointly: $242,000 – $252,000

Married Filing Separately: $0 – $10,000

Understanding these thresholds is critical for avoiding excess contributions and identifying alternative planning strategies.

Why These Changes Matter

Tax updates don’t exist in isolation. Changes to contribution limits, income thresholds, and account rules can impact:

Retirement savings strategy

Roth vs. Traditional contribution decisions

Cash flow planning

Long-term tax efficiency

At Keeler & Nadler Family Wealth, we believe informed and proactive tax planning is a cornerstone of long-term financial success. Every financial situation is unique, and the right strategy often depends on how these rules interact with your broader financial picture.

Let’s Plan Ahead

We encourage you to connect with our team for a personalized conversation about how the 2025 tax updates affect your specific goals. Together, we can evaluate opportunities, avoid costly mistakes, and align your tax strategy with your long-term wealth plan.

Keeler & Nadler Family Wealth is proud to serve individuals and families across Central Ohio, including Dublin, Columbus, Powell, Worthington, and Hilliard.

More Recent Blogs

Smart money tips & life planning advice

Valuable Tips When Car Shopping

Valuable Tips When Car ShoppingAndy KeelerFeb 4, 2019 | 2 min read When shopping for a car, keep your “trade-in” to yourself until the purchase price is agreed to. No matter whether you are buying new or used, or leasing, the purchase price matters. Websites such as...

Making Financial Goals Stick in 2019

Making Financial Goals Stick in 2019Mark Beaver Jan 9, 2019 | 2 min readMark Beaver recently appeared on Fox 28's Good Day Columbus to discuss tips on getting your finances right in the New Year. Check is out here:...

Before You Let Market Volatility Get To You – Let’s Press Pause for a Moment…

Before You Let Market Volatility Get To You - Let's Press Pause for a Moment…Andy KeelerOct 30, 2018 | 2 min readAfter finishing the first three quarters up over 10%, the S&P 500 reversed course this month and is in the red for the year (source: Morningstar)....

Can We Rely on Social Security?

Can We Rely on Social Security?Andy KeelerJun 28, 2018 | 3 min read“The reports of my death have been greatly exaggerated.” -Mark Twain For years, many Americans have doubted the likelihood of receiving Social Security benefits by the time they reach retirement age....

Tune Out the Noise

Tune Out the NoiseMark BeaverJun 13, 2018 | 2 min readIn the media world there is a saying: “Bad news sells”. If that is the case, then the financial media sure knows how to sell! A quick online search shows how pessimistic headlines dominate, even as things improve....

2018 Tax Facts and Figures

2018 Tax Facts and FiguresMark BeaverFeb 9, 2018 | 1 min readNow that the Tax Cuts and Jobs Act as been signed into law, we now have details to help in our tax planning efforts. Changes that will affect many tax filers are new income tax brackets, the doubling of the...

Home Equity Line Interest-It MAY Be Deductible After All

4 Charitable Giving StrategiesAndy Keeler Feb 9, 2018 | 2 min readIf loan proceeds were used to ACQUIRE, BUILD or make significant improvements.... In the rush to get news on the recently passed Tax Cut and Jobs Act out into the public domain, a good number of...

Dow 20,000! What’s Next?

If you are one to pay any attention to the financial media (If you’re not, good for you!) then you have probably heard that the Dow Jones Industrial Average finally moved past the 20,000 milestone on January 25th.

Have you received a threatening email or phone call from the IRS? Be very skeptical!

The IRS has issued continued warnings of various scam attempts on American taxpayers. These take the form of emails, phone calls and even text messages called “Phishing”. These scams try to get sensitive material like Social Security numbers and other financial information.

Don’t Believe the Hype

After the stock market experienced its worst quarter since 2011, it’s time to reflect and offer some advice on how to handle turbulence. Some of you may have looked at your September 30th statement with shock and disappointment.