Mark Beaver

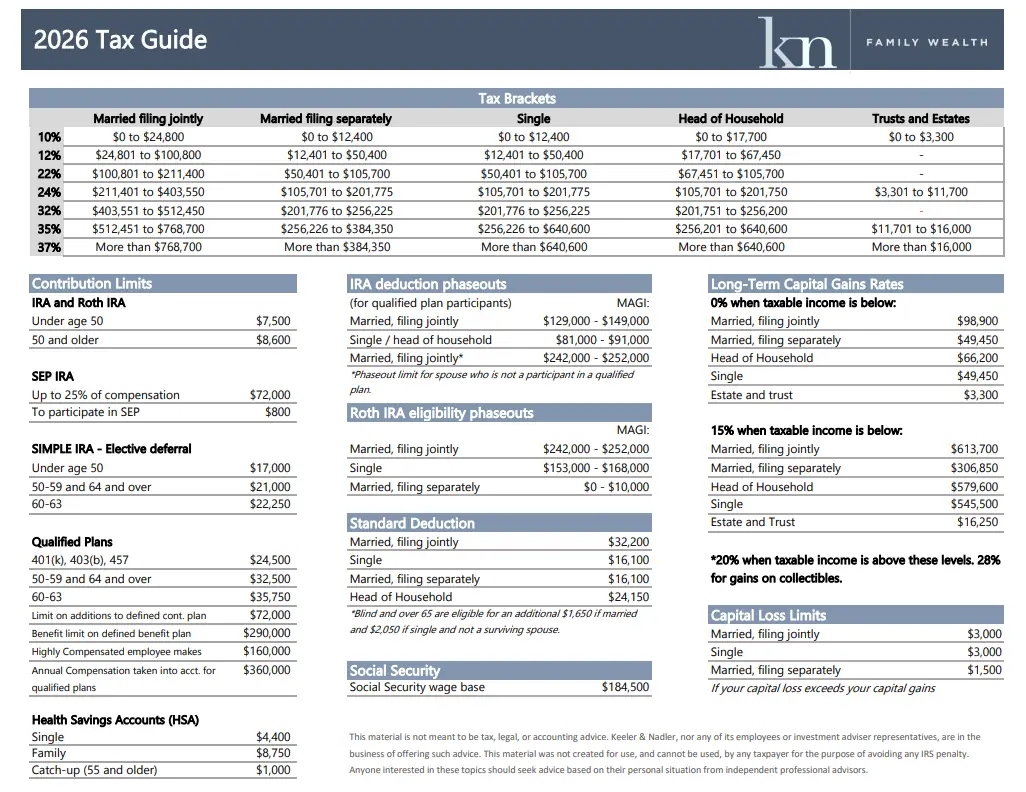

The Keeler & Nadler Family Wealth 2026 Tax Guide is now available.

Each year, tax law updates create new planning opportunities and potential pitfalls for individuals, families, and business owners. Our latest guide highlights the most important changes you need to be aware of as you plan for the year ahead.

Feburary 11, 2026 | 11 min read

Key Tax Updates for 2026

Retirement Plan Contribution Limits

Several retirement account limits have increased, creating new opportunities for tax-efficient saving:

401(k) / 403(b) / TSP & Employer-Sponsored Plans

Employee contribution limit increased to $24,500

Catch-up contribution for individuals age 50+ increased to $8,000

Enhanced catch-up contribution for ages 60–63 remains $11,250

Maximum Total Employee Contribution

Ages 50–59 or 64+: $32,500

Ages 60–63: $35,750

Important note: Catch-up contributions will be required to be Roth contributions if your income exceeded $150,000 in 2025, adding another layer of planning consideration.

IRA & Roth IRA Contribution Limits

Contribution limit increased to $7,500

Catch-up contribution (age 50+) increased to $1,100

These limits apply to the combined total of Traditional and Roth IRA contributions.

Roth IRA Income Phase-Out Ranges (MAGI)

Eligibility for Roth IRA contributions continues to phase out at higher income levels:

Single or Head of Household: $153,000 – $168,000

Married Filing Jointly: $242,000 – $252,000

Married Filing Separately: $0 – $10,000

Understanding these thresholds is critical for avoiding excess contributions and identifying alternative planning strategies.

Why These Changes Matter

Tax updates don’t exist in isolation. Changes to contribution limits, income thresholds, and account rules can impact:

Retirement savings strategy

Roth vs. Traditional contribution decisions

Cash flow planning

Long-term tax efficiency

At Keeler & Nadler Family Wealth, we believe informed and proactive tax planning is a cornerstone of long-term financial success. Every financial situation is unique, and the right strategy often depends on how these rules interact with your broader financial picture.

Let’s Plan Ahead

We encourage you to connect with our team for a personalized conversation about how the 2025 tax updates affect your specific goals. Together, we can evaluate opportunities, avoid costly mistakes, and align your tax strategy with your long-term wealth plan.

Keeler & Nadler Family Wealth is proud to serve individuals and families across Central Ohio, including Dublin, Columbus, Powell, Worthington, and Hilliard.

More Recent Blogs

Smart money tips & life planning advice

Social Security Madness: What’s in Your Team’s Playbook?

Social Security Madness: What’s in Your Team’s Playbook? Mark BeaverJun 12, 2015 | 3 min readAmericans love team sports. This year, over 23 million people tuned in to watch the college basketball playoffs. What makes team sports great is seeing an individual work with...

The Million Dollar Question

The Million Dollar Question Mark BeaverApr 6, 2015 | 3 min readHow long will I live? If you know that, you should get a job reading tarot cards. For obvious reasons, a lot is riding on how long you will be around. It’s interesting to hear responses to that simple...

Groceries and Football

Groceries and Football Mark BeaverFeb 23, 2015 | 3 min readI confess that the idea for this article is not entirely my own. The statistics professor my sophomore year is to blame. He introduced me to Darrell Huff’s 1954 book titled “How to Lie With Statistics”. I...

Creating a Financial Plan – Step 1: Don’t Sabotage the Plan!

Creating a Financial Plan – Step 1: Don’t Sabotage the Plan! Mark BeaverMay 1, 2014 | 3 min readSometimes when we discuss establishing an emergency fund with clients, we can almost feel their collective sigh. I agree this isn’t the most exciting part of one’s...

Long Term Care Insurance: Is it Right For You?

Long Term Care Insurance: Is it Right For You? Mark BeaverMar, 31 2014 | 3 min readWhile baby boomers are aging, so are their parents. As clients get more and more involved in the process of moving their folks out of the family home and into the next phase of living,...