No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Valuable Tips When Car Shopping

Valuable Tips When Car ShoppingAndy KeelerFeb 4, 2019 | 2 min read When shopping for a car, keep your “trade-in” to yourself until the purchase price is agreed to. No matter whether you are buying new or used, or leasing, the purchase price matters. Websites such as...

Making Financial Goals Stick in 2019

Making Financial Goals Stick in 2019Mark Beaver Jan 9, 2019 | 2 min readMark Beaver recently appeared on Fox 28's Good Day Columbus to discuss tips on getting your finances right in the New Year. Check is out here:...

Before You Let Market Volatility Get To You – Let’s Press Pause for a Moment…

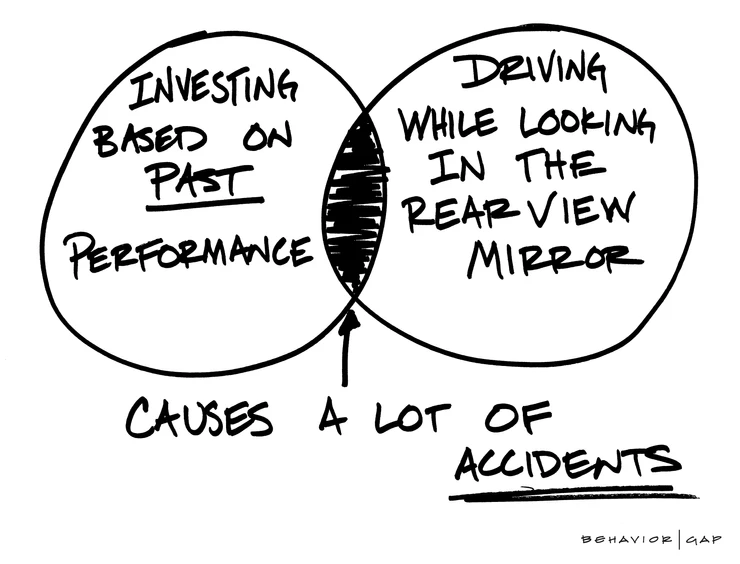

Before You Let Market Volatility Get To You - Let's Press Pause for a Moment…Andy KeelerOct 30, 2018 | 2 min readAfter finishing the first three quarters up over 10%, the S&P 500 reversed course this month and is in the red for the year (source: Morningstar)....

Can We Rely on Social Security?

Can We Rely on Social Security?Andy KeelerJun 28, 2018 | 3 min read“The reports of my death have been greatly exaggerated.” -Mark Twain For years, many Americans have doubted the likelihood of receiving Social Security benefits by the time they reach retirement age....

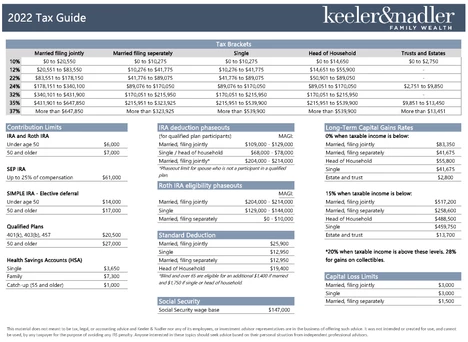

2022 Tax Guide

2022 Tax Facts and FiguresMark BeaverFeb 9, 2022 | 2 min readThe Keeler & Nadler Tax Guide for 2022 is now available! In addition to updated tax brackets and retirement account funding limits, this year's edition includes new information on Medicare surcharges...

4 Charitable Giving Strategies

4 Charitable Giving StrategiesMark BeaverNov 3, 2020 | 1 min readBuilding wealth and financial security for your family is a wonderful thing, but there are many benefits - both financially and personally - to giving away some of that wealth. There is a lot to be said...

Our Newest CFP!

Our Newest CFP!Mark BeaverMay 17, 2020 | 1 min readIt is with great pride that Keeler & Nadler Family Wealth wishes to announce and extend congratulations to Jessica Hultberg for her recent achievement of her CERTIFIED FINANCIAL PLANNER (CFP®) designation, making...